Benefits:

Get instant personal loan of up to 2.5 lakh

Interest rate starting from 11.5% p.a.

No Document required

Flexible tenure of up to 36 months

Facility of transferring existing loan & credit card balance is available

Whom to sell?

- Available for salaried employees only

- Customer's salary should be credited in their bank account or by cheque.

- Age: above 21 years

- Net Monthly Income: 25,000 above

- Minimum work experience: 12 months

- The Aadhaar and PAN of the customers should be linked

- Customers having official email ID where domain check can be done and they must be deducting EPF and their record is appearing in the EPFO.

- Customer should apply from their mobile device. Multiple applications from same device will be rejected.

How it works

- Watch all the training videos and share the product link with your customer.

- Customer will be redirected to the SMFG India Credit website.

- Select job type: salaried or self employed.

- Enter and verify mobile number, PAN, Current pincode using OTP.

- Enter basic details - name, personal email ID, date of birth, type of organization, net monthly income, work experience and other details.

- Eligible credit limit will be displayed on the screen, with loan amount, tenure and EMIS.

- Enter the Employment Details: - Employer Name, Official Email ID (domain should be same as the company's name), Office Address.

- Income verification form EPFO

- Desired loan amount will be shown on the screen with EMI, tenure and rate of interest.

- Wait for the verification of the details.

- After successful loan application, upload the required documents to complete the process.

- Documents Required:

(a) Photo

(b) ID Proof

(c) Current Residence Address Proof

(d) Office Address Proof

(e) Income Proof

(f) Reference

- Customer needs to be in the Current Address

Location city for Geo-tagging

Terms & Conditions

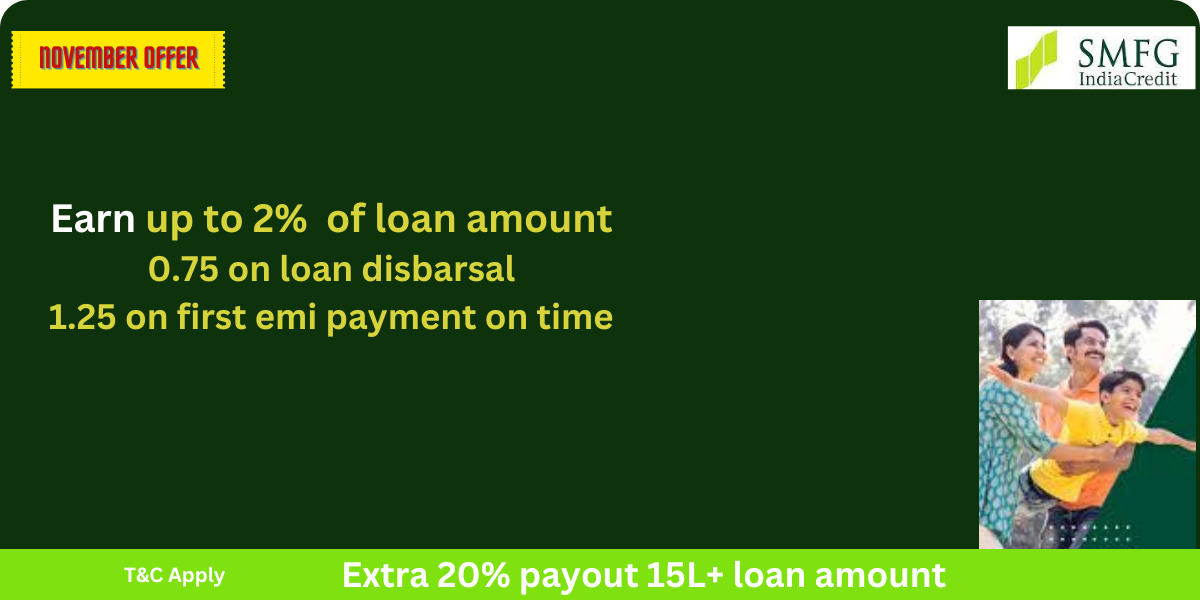

Payout T&C

- 0.75% of Loan amount on successful loan disbursal

- 1.25% of loan amount on first EMI payment by customer on time

- Documents Required:

(a) Photo

(b) ID Proof

(c) Current Residence Address Proof

(d) Office Address Proof

(e) Income Proof

(f) Reference

- For Loan Balance Transfer cases, the latest 6 month EMI payment proof and repayment schedules are required. There should be no bounces in the last 6 months.