benefits:

Lifetime Free Credit Card

UPI payments, now with Credit Card

Earn 2 Reward Points for every ₹ 100 on non-UPI transactions

Earn 1 Reward Point for every 100 on UPI transactions

B 1% Fuel Surcharge Waiver*

Whom to sell?

- Credit score above 700 and no negative credit remarks

- Annual income: 3 lakh and above

- Age: 21 - 60 years

- Valid Pan & Aadhaar card

- The card is available for selected pin codes

Only

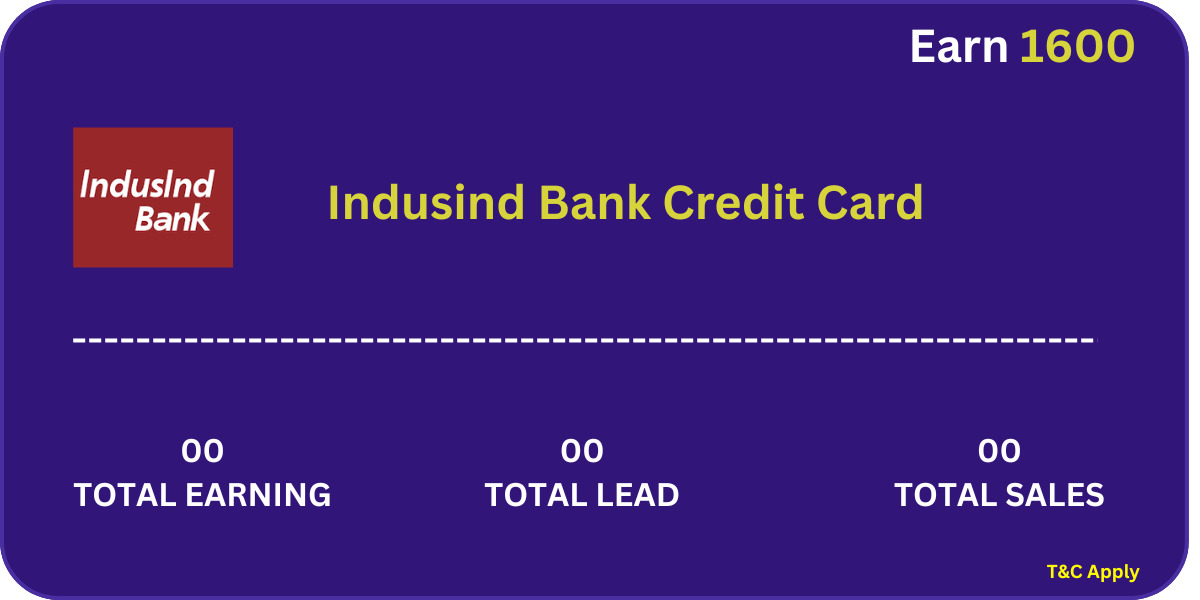

How it works?

- Watch the training video

- Share the link with everyone in your network (friends/customers).

- A customer clicks on the shared link, redirects to the IndusInd Credit Card website, and

completes their application process.

- Once the card has been dispatched your income gets credited to your GroMo wallet during the payout cycle.

- Your customer should activate the credit card by making their 1st transaction within 30 days. If the card is not activated or canceled by the customer, a penalty will be charged.

- Tracking time: 7 days

Terms & Conditions

- Customers should have a valid Aadhaar number and PAN card.

- The Aadhar card should be linked to the mobile number that they are using.

- The payout will be paid when the credit card has been approved and dispatched to the customer.

- Customers should have their Proof of residence if the address in the Aadhaar card is not the current one.

- Customer's minimum age when applying for the credit card should be 21 years.

- Customer's maximum age at the time of applying for the credit card should be 60 years or the retirement age, whichever is earlier.

- Customer's net monthly income needs to be a minimum of 25,000.

- Ensure that your customer completes the entire journey in one attempt. In case the journey is not done in one attempt you will not be eligible for the payout.