Benefits:

No collateral required

Flexible repayment tenure of up to 60 months

Loan amount ranging from ₹20,000 to 10 Lakhs

Interest rate starting from 1.33% p.m.

No income proof needed

Whom to sell?

- Available for Salaried and Self Employed both

- Age: 21-55 years old

- Monthly Income > 20,000

- Customer should have a valid PAN Card

- Credit History > 12 months

- Credit Score > 650

- Available for limited pin codes

How it works?

- Watch the training video and share the link with eligible customers in your network.

- The customer will be redirected to your personalized page, where they will have to fill in their basic details.

- Post this customer will get redirected to the official website of InCred Finance.

- Enter mobile number and PAN.

- Enter OTP and give consent to fetch the credit report

- Enter basic details like date of birth, pincode, net monthly income, current residence type, marital status and purpose of loan.

- Select employment type and gender.

- Offer screen would be shown on the web with tentative offers for the customer.

- The customer will have to download the app to accept the offer and move ahead.

- SMALL TICKET JOURNEY (Instant, no income proof required)

(a) Capture a selfie, fill the current address, complete the KYC process.

(b) Loan Agreement will be shown on the screen.

(c) Enter bank account details. 1 will be credited to the bank account for verification.

(d) Set up auto repayment via eNACH, which can be completed using Debit Card or Netbanking.

- BIG TICKET JOURNEY (Higher loan amount - High Earning)

(a) Capture a selfie, fill the current address, complete the KYC process.

Loan Agreement will be shown on the screen.

(b) Income Verification step: Upload bank statements of last 3 months

(c) Enter bank account details. 1 will be credited to the bank account for verification.

Terms & Conditions

- Self employed Customers can get only the small ticket size loan.

- New to credit (Credit Score -1) customer with salary above 20,000 per month are also eligible.

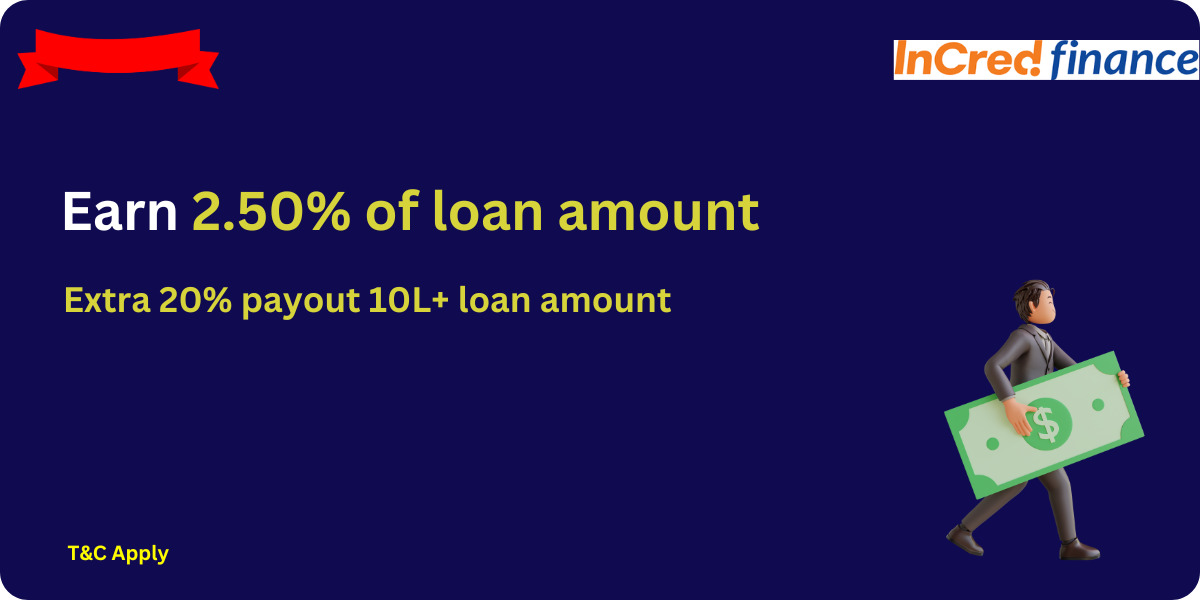

- September Offer: If total loan disbursement by a Partner in the month is above 4 Lakh, then the payout will be 4.5% of the disbursed loan amount.

- Extra 1.25% payout will be released to the eligible Partners by 10th October.

DOS

- Share "Best Loan Offer" link with customers to find their loan eligibility.

- Follow up with customers to complete KYC and upload required documents.

- For app based loans, complete the process on the customer's device by using your shared link only.

- Select "Self Employed" category, if the customer does not receive salary in a bank account.

- Check the pincode according to the customer's Current Address proof.

- Use the "My Customer" section to check loan status and remind them to complete the process.

- Customer details(PAN, phone number, etc) on lender's application should be same.

DON'Ts

- Don't provide any incorrect/false information like customer name, address, mobile number, PAN in the loan application.

- Don't edit or modify any documents for the loan application.

- Identify yourself as Partner and not brand/ company employee/agent.

- Never promise loan amount, interest rate or processing fee upfront to the customers. The customer should always verify all the details on the brand's page or application.